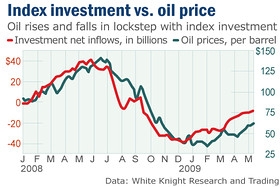

A recent article shows the chart to the left which demonstrates the correlation between crude oil prices and the size of the passive long-only institutional investor.

A recent article shows the chart to the left which demonstrates the correlation between crude oil prices and the size of the passive long-only institutional investor.So what is going on? How can these behemoth institutional players treat the crude oil market like their very own ponzi scheme? Last year the effects on the world economy were devastating. Wealthy economies stalled into a recession and poor economies were thrown into chaos as staple food prices soared.Passive investors increased their crude-oil holdings to the equivalent of more than 600 million barrels in June, up more than 30% from the end of last year…

What makes this even more astonishing is that last year’s oil spike (or bubble) happened when the world was awash in oil supply and faced a drastically reduced oil demand!Between 2003 and 2008, the amount of speculative money in commodities grew from $13 billion to $317 billion, an increase of 2,300 percent.

This whole bear market has been a massive lesson in the validity and value of smart government regulations. As Ritholtz counts off in his book “Bailout Nation”, over a number of years and even decades, the threads of regulation where one by one removed. As the regulatory framework deteriorated in tatters, things started to go wrong.…according to the US Energy Information Administration,the world oil supply rose from 85.24 million barrels a day to 85.72 million. Over the same period, world oil demand dropped from 86.82 million barrels a day to 86.07 million.

By the summer of 2008, in fact, commodities speculators had bought and stockpiled enough oil futures to fill 1.1 billion barrels of crude, which meant that speculators owned more future oil on paper than there was real, physical oil stored in all of the country’s commercial storage tanks and the Strategic Petroleum Reserve combined.

| 欢迎光临 华人论坛 (http://webmail.yayabay.com/forum/) | Powered by Discuz! 7.2 |